Latest Post

Mitesh Jadav

Ideogram AI: A Comprehensive Review 2024

The rapidly growing field of Artificial Intelligence is introducing a new generation of tools that … Read More

Mitesh Jadav

Clipdrop AI: The Ultimate AI-Powered Ecosystem for Creators

The digital landscape thrives on captivating visuals. Whether you’re a seasoned graphic designer or a … Read More

Mitesh Jadav

Afforai: Simplify Your Research [2024]

Are you tired of those AI chatbots that give you fuzzy and unreliable responses? Worry … Read More

Mitesh Jadav

Prome AI: Review, Features, Pricing, Pros & Cons

Looking for an in-depth review of Prome AI? Look no further! In this comprehensive article, … Read More

Mitesh Jadav

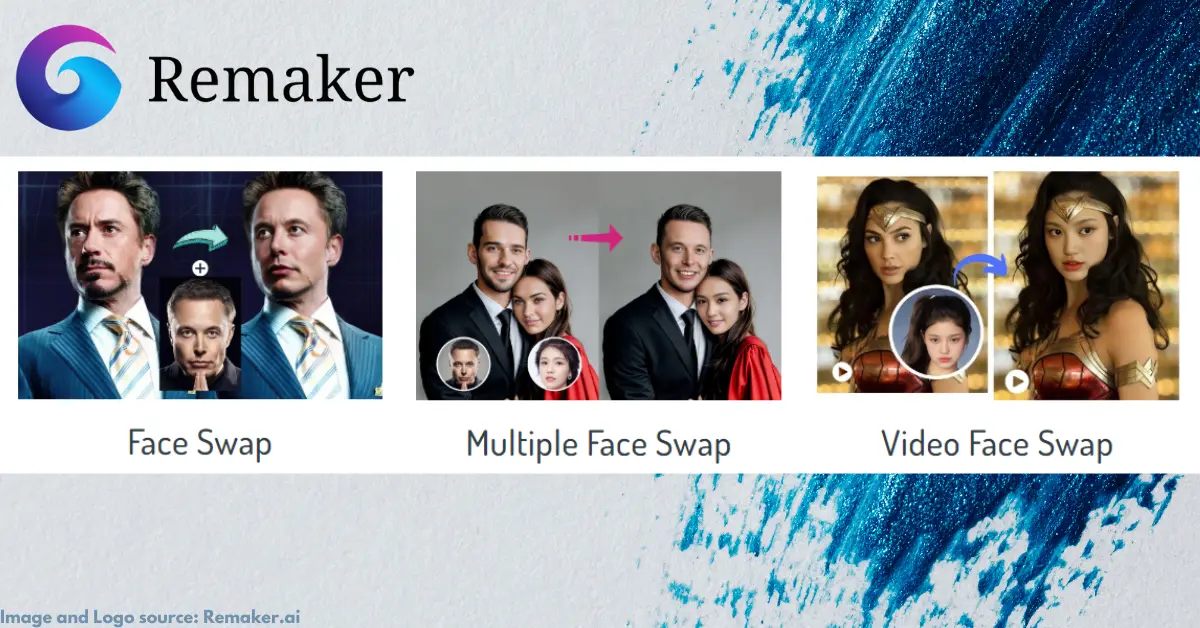

Explore Remaker AI in 2024: Price, Features, Pros, and Cons

Have you ever wished to be portrayed in a history painting? Perhaps, as a social … Read More

Mitesh Jadav

Transform Your Setup with a Hot Swappable Keyboard in 2024

Innovation facilitates the generation of items that stand up to and even surpass our requirements. … Read More

Mitesh Jadav

Your Ideal Fit: The Best Low Profile Mechanical Keyboard [2024]

In the hunt for the best keyboards, I ended up resulting in the best low … Read More

Mitesh Jadav

The 5 Best Cell Phone Stand for Desk to Try Out in 2024

Looking for the best phone stand for desk or recording? Whether it’s a cell phone … Read More

Mitesh Jadav

Level Up Your Look: Copyright-Free Images That Pop

Finding high-quality, copyright-free images for your website or blog can seem tricky. So, are you … Read More

Mitesh Jadav

Live Location Sharing is Now Supported by Google Maps

Tech giant Google recently introduced live location sharing features in their recent update of Google … Read More

Mitesh Jadav

Why is iPhone Battery Yellow? Let’s Understand

Have you ever noticed why is iPhone battery yellow? This change can be surprising, but … Read More

Mitesh Jadav